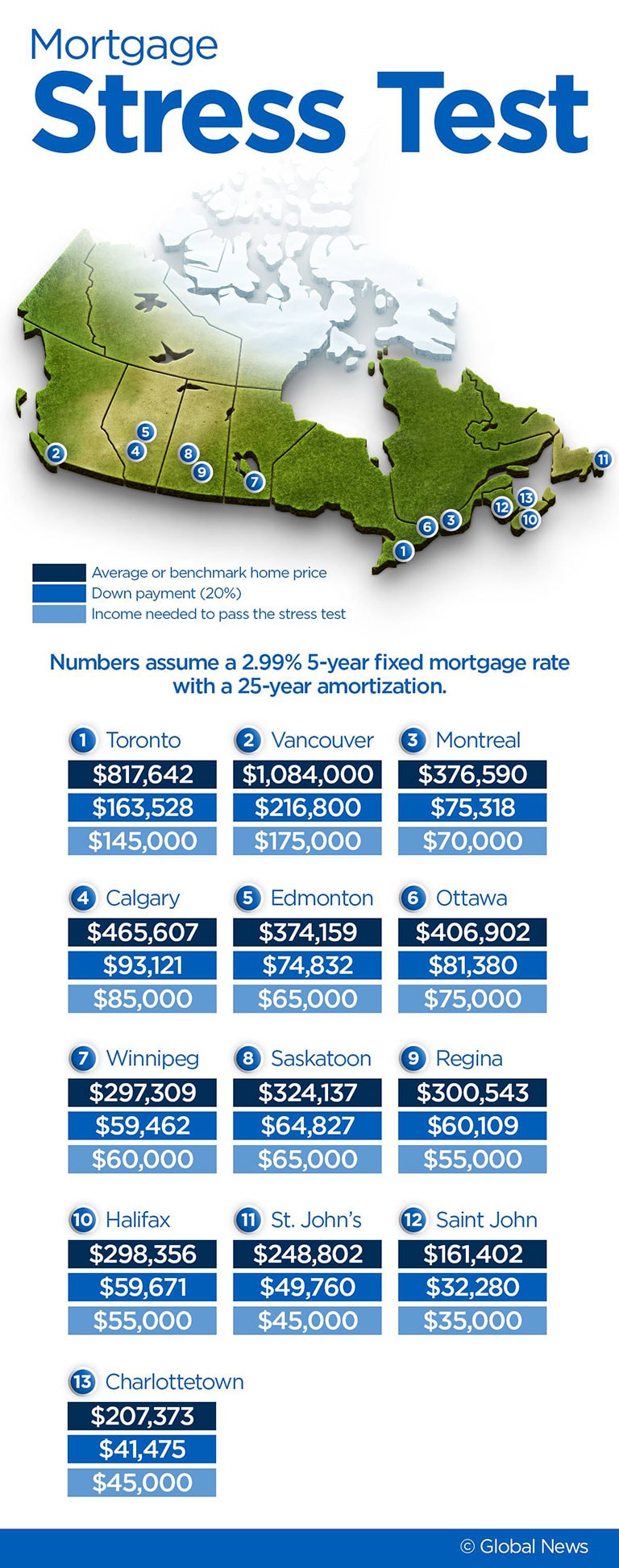

Numbers Assume a 2.99% 5-Year Fixed Mortgage Rate Wth a 25-Year Amortization.

The average price of a home in Canada is $491,000 according to the Canadian Real Estate Association (CREA).

And if you take out Toronto and Vancouver, the national average is slipped to 2% in the last 12 months. Under the new Mortgage Stress Test, target buyers now have to prove that they will be able to catch up with their bills even if their mortgage rate rose to .02 points.

In Toronto and Vancouver, Canada’s two most expensive markets, people are now turning to another less pricey condo and townhomes due to stricter mortgage rules.

So, how much and what is the average income these days to qualify for a loan to buy an average-priced house in Canada’s largest cities?

Based on the mortgage affordability calculator from the site Ratehub.ca, here are the numbers we got, see the image on the left side.